Record Resources Finalises Hydrogen Exploration Plans for its Lake Temiskaming Properties, Ontario.

Hydrogen Exploration Plans Finalised

May 29, 2025 — Record Resources (TSX-V: REC) reports that following technical discussions and evaluations it has finalized plans for a comprehensive hydrogen exploration work program on its hydrogen properties at Lake Temiskaming, Ontario.

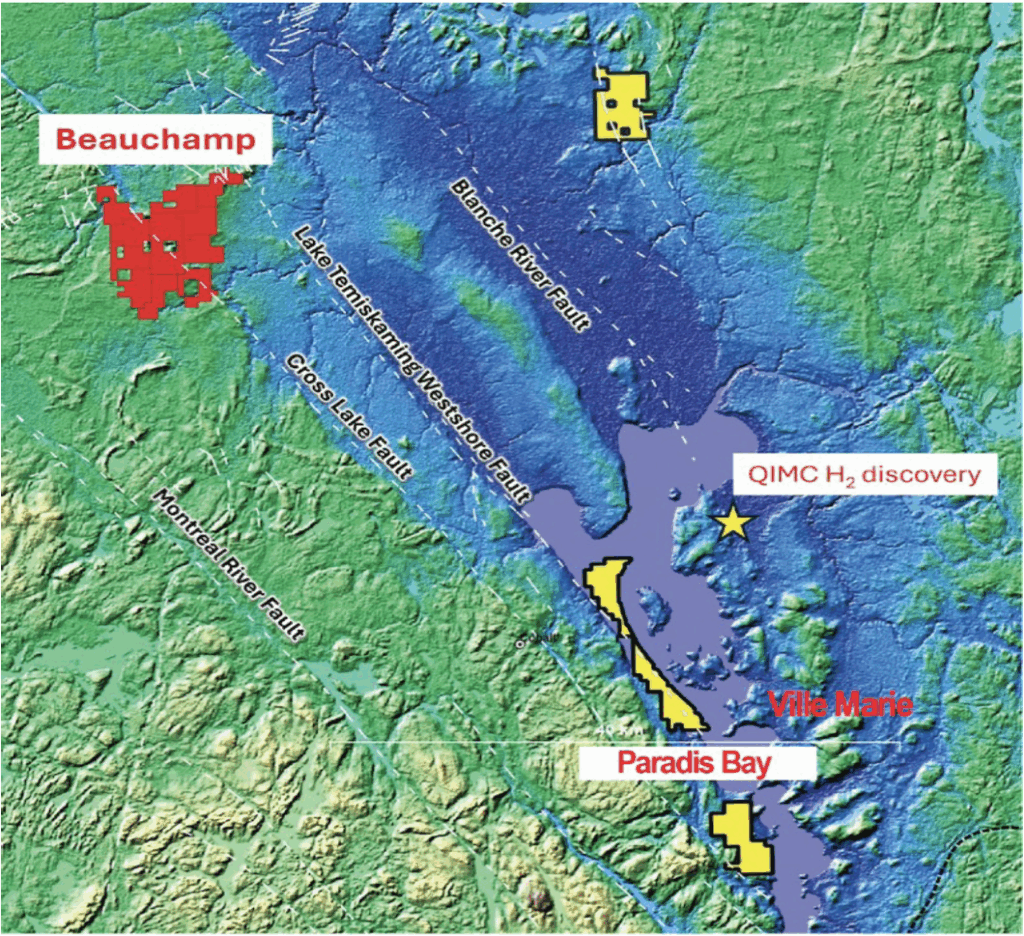

The full program is a multi-disciplinary approach combining geochemistry, geology and geophysics with the objective of defining a working total hydrogen system and play fairways that will help map out and generate hydrogen gas leads and prospects. (See Fig 1 Map below)

The program to be phased out over the next 12 months will culminate in the drilling of our first hydrogen exploration wells targeting the most promising hydrogen prospects that will be defined and confirmed during the course of the work program.

The initial phase of exploration will be aimed at sampling the soil on a regular grid in order to measure the presence of anomalous levels of hydrogen, helium and other useful indicator gases such as nitrogen and methane. The sampling procedures to be used not only detect the presence of hydrogen, helium and other gases in the soil but over sampling time intervals at the site also indicate the flow rate of the gases into the sample chamber and indirectly calculate the vector direction to the sources of the gas potentially trapped much deeper in the subsurface.

The methods to be used by Record Resources will initially define local scale gases fields for hydrogen and helium that seep out and are transferred to the atmosphere via diffusive or advective processes after migrating through existing fault systems.

The company plans to initiate a phased SGS (Soil Gas Survey) program. Phase 1 SGS shall consist of regional sectional SGS on a 100m grid spacing using conical auger sampling one meter below ground to measure hydrogen and undertake mass spectrometry measurement of free gas in the vadose zone using steel probes developed by Geofrontiers USA to measure helium.

Phase 2 SGS will tighten the grid to 25-10m precision sampling on anomalous hydrogen and/or helium zones identified during Phase 1 using conical auger sampling for hydrogen and PHD-4 detectors to measure any helium detected in the field.

Work will also include UAV-Drone base detailed aeromagnetic, LIDAR, and satellite based hyperspectral surveys to better define the structures that may be tapping deeper areas where natural hydrogen and associated gases are being generated or stored as reservoirs.

These multi-disciplinary tools including geochemistry, geology and geophysical data will eventually be coupled with targeted 2D or 3D seismic data acquisition to allow the final definition of potential hydrogen leads and prospects both at a local and regional scale capable of trapping commercial gas accumulations that will be subsequently tested by drilling.

“The technical team has a firm grip on the way forward for our hydrogen-prospective Temiskaming properties,” said Michael Judson, Chairman and CEO. “This work is essential in allowing Record to eventually discover the first ever commercial hydrogen deposits in Ontario. It is a very comprehensive work program aligned with other similar natural hydrogen and helium exploration projects in Europe, Africa and Australia.”

For more information please contact:

Michael C. Judson, Chairman & CEO

Record Resources Inc.

T. +1-514-865-5496

Website: recordresourcesinc.com

- Dugamin, E., Truche, L. and Donze, F.V., 2019. Natural hydrogen exploration guide. ISRN Geonum-NST, 1, p. 16.

- Ely, T.D., Leong, J.M., Canovas, P.A. and Shock, E.L., 2023. Huge variation in H2 generation during seawater alteration of ultramafic rocks. Geochemistry, Geophysics, Geosystems, 24 (3),p.e 2022GC010658.Figure 1: Map courtesy Perry English from OGS Map M236 and Quebec Innovative Material news releases in 2024.

- Moretti, I., Brouilly, E., Loiseau, K., Prinzhofer, A. and Deville, E., 2021. Hydrogen emanations in intracratonic areas: new guide lines for early exploration basin screening. Geosciences, 11 (3), p. 145.

- Moretti, I., Prinzhofer, A., Françolin, J., Pacheco, C., Rosanne, M., Rupin, F. and Mertens, J., 2021. Long-term monitoring of natural hydrogen superficial emissions in a brazilian cratonic environment. Sporadic large pulses versus daily periodic emissions. International Journal of Hydrogen Energy, 46 (5), pp. 3615-3628.

- Mahlstedt, N., Horsfield, B., Weniger, P., Misch, D., Shi, X., Noah, M. and Boreham, C., 2022. Molecular hydrogen from organic sources in geological systems. Journal of Natural Gas Science and Engineering, 105, p. 104704.

- Boreham, C.J., Edwards, D.S., Feitz, A.J., Murray, A.P., Mahlstedt, N. and Horsfield, B., 2023. Modelling of hydrogen gas generation from overmature organic matter in the Cooper Basin, Australia. The APPEA Journal, 63 (2), pp. S351-S356.

- Michael Doughty, Nick Eyles, Carolyn Eyles, 17, October 2012. High-resolution seismic reflection profiling of neotectonic faults in Lake Timiskaming, Timiskaming Graben, Ontario-Quebec, Canada.

Fig 1: Map of the Temiskaming graben, Record Properties and QIMC hydrogen showing. Note some faults shown on the Ontario side of the lake corresponding to topographic escarpments.

May 29, 2025 — Record Resources (TSX-V: REC) reports that following technical discussions and evaluations it has finalized plans for a comprehensive hydrogen exploration work program on its hydrogen properties at Lake Temiskaming, Ontario.

The full program is a multi-disciplinary approach combining geochemistry, geology and geophysics with the objective of defining a working total hydrogen system and play fairways that will help map out and generate hydrogen gas leads and prospects. (See Fig 1 Map below)

The program to be phased out over the next 12 months will culminate in the drilling of our first hydrogen exploration wells targeting the most promising hydrogen prospects that will be defined and confirmed during the course of the work program.

The initial phase of exploration will be aimed at sampling the soil on a regular grid in order to measure the presence of anomalous levels of hydrogen, helium and other useful indicator gases such as nitrogen and methane. The sampling procedures to be used not only detect the presence of hydrogen, helium and other gases in the soil but over sampling time intervals at the site also indicate the flow rate of the gases into the sample chamber and indirectly calculate the vector direction to the sources of the gas potentially trapped much deeper in the subsurface.

The methods to be used by Record Resources will initially define local scale gases fields for hydrogen and helium that seep out and are transferred to the atmosphere via diffusive or advective processes after migrating through existing fault systems.

The company plans to initiate a phased SGS (Soil Gas Survey) program. Phase 1 SGS shall consist of regional sectional SGS on a 100m grid spacing using conical auger sampling one meter below ground to measure hydrogen and undertake mass spectrometry measurement of free gas in the vadose zone using steel probes developed by Geofrontiers USA to measure helium.

Phase 2 SGS will tighten the grid to 25-10m precision sampling on anomalous hydrogen and/or helium zones identified during Phase 1 using conical auger sampling for hydrogen and PHD-4 detectors to measure any helium detected in the field.

Work will also include UAV-Drone base detailed aeromagnetic, LIDAR, and satellite based hyperspectral surveys to better define the structures that may be tapping deeper areas where natural hydrogen and associated gases are being generated or stored as reservoirs.

These multi-disciplinary tools including geochemistry, geology and geophysical data will eventually be coupled with targeted 2D or 3D seismic data acquisition to allow the final definition of potential hydrogen leads and prospects both at a local and regional scale capable of trapping commercial gas accumulations that will be subsequently tested by drilling.

“The technical team has a firm grip on the way forward for our hydrogen-prospective Temiskaming properties,” said Michael Judson, Chairman and CEO. “This work is essential in allowing Record to eventually discover the first ever commercial hydrogen deposits in Ontario. It is a very comprehensive work program aligned with other similar natural hydrogen and helium exploration projects in Europe, Africa and Australia.”

For more information please contact:

Michael C. Judson, Chairman & CEO

Record Resources Inc.

T. +1-514-865-5496

Website: recordresourcesinc.com

Cautionary Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes”, an or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would” , “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: approval of the Private Placement and obtaining a full revocation order. This forward-looking information reflects the Company’s current beliefs and is based on information currently available to the Company and on assumptions the Company believes are reasonable. These assumptions include, but are not limited to: the market acceptance of the Private Placement; the ability of the Company to obtain a full revocation order and the receipt of all required approvals in connection with the foregoing. Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: general business, economic, competitive, political and social uncertainties; general capital market conditions and market price for securities; and the delay or failure to receive board, shareholder, court or regulatory approvals. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned that the foregoing list of factors is not exhaustive. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The Units and the securities comprising the Units have not been and will not be registered under the United States Securities Act of 1933, as amended and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement. This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor shall there be any sale of securities in the Unites States, or any other jurisdiction, in which such offer, solicitation or sale would be unlawful. Not for distribution to U.S. Newswire Services or for dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. Securities laws.

- Dugamin, E., Truche, L. and Donze, F.V., 2019. Natural hydrogen exploration guide. ISRN Geonum-NST, 1, p. 16.

- Ely, T.D., Leong, J.M., Canovas, P.A. and Shock, E.L., 2023. Huge variation in H2 generation during seawater alteration of ultramafic rocks. Geochemistry, Geophysics, Geosystems, 24 (3),p.e 2022GC010658.Figure 1: Map courtesy Perry English from OGS Map M236 and Quebec Innovative Material news releases in 2024.

- Moretti, I., Brouilly, E., Loiseau, K., Prinzhofer, A. and Deville, E., 2021. Hydrogen emanations in intracratonic areas: new guide lines for early exploration basin screening. Geosciences, 11 (3), p. 145.

- Moretti, I., Prinzhofer, A., Françolin, J., Pacheco, C., Rosanne, M., Rupin, F. and Mertens, J., 2021. Long-term monitoring of natural hydrogen superficial emissions in a brazilian cratonic environment. Sporadic large pulses versus daily periodic emissions. International Journal of Hydrogen Energy, 46 (5), pp. 3615-3628.

- Mahlstedt, N., Horsfield, B., Weniger, P., Misch, D., Shi, X., Noah, M. and Boreham, C., 2022. Molecular hydrogen from organic sources in geological systems. Journal of Natural Gas Science and Engineering, 105, p. 104704.

- Boreham, C.J., Edwards, D.S., Feitz, A.J., Murray, A.P., Mahlstedt, N. and Horsfield, B., 2023. Modelling of hydrogen gas generation from overmature organic matter in the Cooper Basin, Australia. The APPEA Journal, 63 (2), pp. S351-S356.

- Michael Doughty, Nick Eyles, Carolyn Eyles, 17, October 2012. High-resolution seismic reflection profiling of neotectonic faults in Lake Timiskaming, Timiskaming Graben, Ontario-Quebec, Canada.

Fig 1: Map of the Temiskaming graben, Record Properties and QIMC hydrogen showing. Note some faults shown on the Ontario side of the lake corresponding to topographic escarpments.